Are you prepared for the complexities of New York State taxes? Navigating the Empire State's tax system can feel like traversing a maze, but understanding the intricacies can lead to significant savings and avoid costly penalties.

New York State's tax landscape is unique, with a top marginal income tax rate of 10.9%, one of the highest in the nation. However, this headline figure often masks the reality. The state's progressive tax system, mirroring the federal model, ensures that higher earners contribute a larger percentage of their income. For those filing in early 2025, dealing with their 2024 taxes, it's crucial to understand the current rates and brackets. Information regarding tax rates and tax tables for New York State, New York City, Yonkers, and the Metropolitan Commuter Transportation Mobility Tax, updated regularly, is readily available.

The state offers various resources to assist taxpayers. Eligible New York taxpayers can leverage the IRS Direct File to manage their federal returns, and subsequently, seamlessly transfer their information into the New York State Direct File system to finalize their state tax returns. Both the IRS Direct File and New York State Direct File systems are accessible via a range of devices, including smartphones, laptops, tablets, and desktop computers, providing convenient access for all taxpayers.

To further simplify the process, the New York State Tax Calculator (NYSTax Calculator) offers a helpful tool. This calculator, powered by the latest federal and state tax tables, allows individuals to estimate their tax return for the 2025/26 tax year; simply choose the 2025 tax year to begin. For the 2024 tax year, the state utilizes nine tax brackets, ranging from 4% to 10.9%. Remember that the factors such as income, filing status, deductions, and applicable credits all influence the ultimate tax liability.

Whether you're a resident, a nonresident, or somewhere in between, the following table provides a detailed breakdown of the tax rates, brackets, and essential filing information:

| Tax Element | Details |

|---|---|

| Tax Year | 2024 (filing in early 2025) |

| Tax Brackets | Nine brackets, ranging from 4% to 10.9% |

| Key Tax Rates | 4%, 10.9% (top marginal rate) |

| Local Taxes | Applies in New York City and Yonkers |

| Filing Requirements | File if you are a New York State resident and meet filing thresholds (based on income) |

| Electronic Filing | Recommended for speed and safety |

| Credits & Deductions | Earned Income Credit (State & City), Household Credit (State & City), various others |

| Tax Calculator | Available on the NY.gov website, including 2024 tax rates and thresholds. |

| Direct File | Eligible taxpayers can use IRS Direct File and seamlessly transfer to New York State Direct File. |

| Pension Income | Nonresident pension income described in section 114 of title 4 of the u.s. Code is not taxable to new york. |

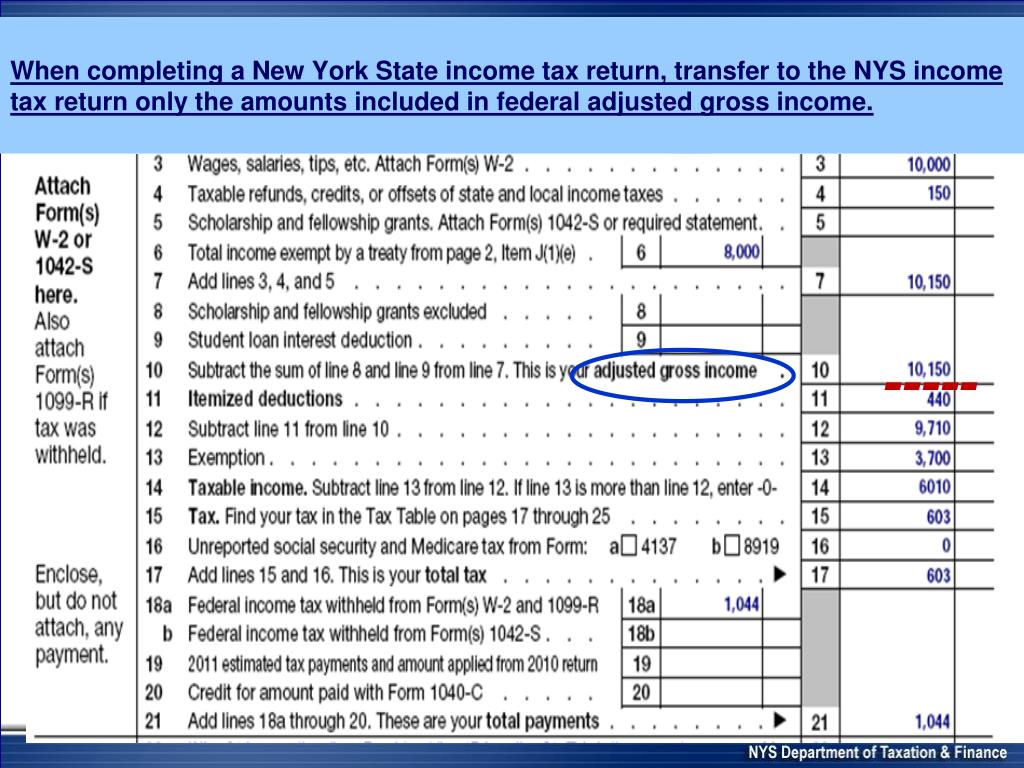

| Itemizing Deductions | You can itemize deductions for NYS income tax purposes regardless of whether you itemized on your federal return, beginning tax year 2018. |

| Rent | Changes apply to collections of rent on and after march 1, 2025. |

For more in-depth information, you can consult the official New York State Department of Taxation and Finance website. Here is the link to their website.

The structure of the New York tax system is designed to apply different rates to different income levels. It's essential to know which bracket applies to your specific income level to accurately calculate your tax liability. Factors such as your filing status (single, married filing jointly, etc.), any eligible deductions, and tax credits will significantly affect the final amount you owe. Remember, you are generally required to file a New York State resident income tax return if you are a New York State resident and meet specific income thresholds.

Electronic filing is often the quickest and most secure way to submit your return. It's worth exploring the options available, especially when aiming for a refund of any taxes withheld from your paychecks or unemployment benefits. If you are entitled to claim any refundable or carryover credits, filing electronically can also expedite the process.

There are various tax credits available, which can further reduce your tax liability. Common examples include the Earned Income Credit, which is applicable at both the state and city levels, and the Household Credit, which also applies to both the state and city levels. Ensure that you are aware of all applicable credits and that you meet the eligibility criteria. You might be surprised at the potential for a larger refund! Remember, failing to accurately follow the instructions can lead to penalties and interest on your reported income tax.

For those in the military, there may be additional tax benefits available under the Servicemembers Civil Relief Act (SCRA), alongside residency election options. In addition, any income received from pension plans mentioned in section 114 of title 4 of the U.S. Code is not taxable to New York State if the individual is a non-resident. For individuals with pensions taxable to New York who are over 59 years old (or turn that age during the tax year), there may be eligibility for a pension and annuity exclusion, potentially saving on taxes. Remember that new york state tax has nine tax brackets for the 2024 tax year, ranging from 4% to 10.9%.

New York State also provides helpful tools and resources, such as the New York State Tax Calculator, a free tool designed to help individuals accurately estimate their return, and with all the latest tax tables incorporated. This tool is invaluable for tax planning. Always source tax information from official sources, and for 2024 tax rates, remember to use the integrated 2024 tax calculator, making the process easier.

New York's tax environment can be demanding, being the state with the most expensive income taxes in the country, with a staggering 5.8% of residents' income collected. However, by understanding the tax system, leveraging available resources, and by taking advantage of any applicable credits, residents can navigate the tax season effectively. Electronic filing, where available, offers a faster, safer, and more efficient option, and the free tools provided are designed to help ensure accuracy. Always remember to consult official NY.gov websites and the Department of Taxation and Finance for accurate information.

For taxpayers who may be eligible, consider using IRS Direct File. Once you've filed your federal return through this system, you can seamlessly transfer information into the New York State Direct File to complete your state return. This integrated approach can significantly streamline the tax preparation process. Moreover, remember to determine if local income taxes, such as those in New York City or Yonkers, apply to you and learn how to calculate your total tax liability.

Finally, remember that the information provided is for general informational purposes only and does not constitute tax advice. Tax laws can change, and the specifics of your tax situation will depend on your individual circumstances. For personalized guidance and assistance, it's always recommended to consult with a qualified tax professional.