Elliott Wave Theory: Insights & Analysis - Get The Latest Trends Today!

Apr 26 2025

Is it possible to predict the unpredictable nature of financial markets? Elliott Wave Theory, with its intricate patterns and predictive capabilities, suggests that the answer might be a resounding yes. This fascinating approach to market analysis, developed in the 1930s, offers a unique lens through which to view the ebb and flow of prices, potentially empowering traders with a significant edge.

On February 28th, long before certain pivotal global events, a noteworthy observation surfaced within the realm of financial analysis. Michael Madden, editor of Elliott Wave International's Currency Pro Service, shared a video with his subscribers. The video included a chart and a specific forecast: "5 waves down from 1.0529 will complete this pattern." This seemingly straightforward statement encapsulates a complex methodology, one that attempts to decipher the underlying structure of market movements. The implications of this analysis reach beyond simple price predictions; it suggests that markets aren't driven solely by random events, but rather by predictable patterns, which can be identified and, to some extent, anticipated.

| Name: | Michael Madden |

| Occupation: | Editor, Elliott Wave International's Currency Pro Service |

| Specialization: | Currency Market Analysis, Elliott Wave Theory |

| Known For: | Providing subscribers with insights and forecasts based on Elliott Wave analysis, including commentary and chart analysis. |

| Published Work: | |

| Published On: | Yahoo Finance, Nasdaq.com, Investing.com, RealClearMarkets, Minyanville, et al. |

| Key Strategy: | Combining Elliott Wave Theory with Classic Technical Analysis. |

| Approach: | Offers in-depth analysis, often including doses of sarcasm, to engage with a knowledgeable forum community. |

| Website Reference: | Elliott Wave International |

The Daneric Elliott Wave represents a sophisticated adaptation of the original Elliott Wave Theory, a framework pioneered by Ralph Nelson Elliott in the 1930s. This method hinges on the identification of recurrent patterns within market price movements, thereby equipping traders with the capacity to forecast future trends with enhanced precision. This approach differs significantly from simply reacting to market fluctuations; it encourages a proactive stance, where analysis precedes action.

For those immersed in the world of technical analysis, the allure of Elliott Wave Theory is undeniable. It provides a roadmap, a framework for interpreting the often-chaotic dance of market prices. This isn't merely about charting; it's about understanding the psychology of the market, the collective emotions of participants as they drive prices higher and lower. The enthusiast often finds themselves combining wave theory with more traditional technical analysis tools to track market movements and formulate predictions.

The Elliott Wave Principle offers a fundamentally new perspective on the dynamics of financial markets. It provides fresh insights into what truly drives market behavior and, crucially, what can be deduced from the way markets move. The implications are far-reaching, promising not only a clearer understanding of market mechanics, but also the potential for more successful trading strategies.

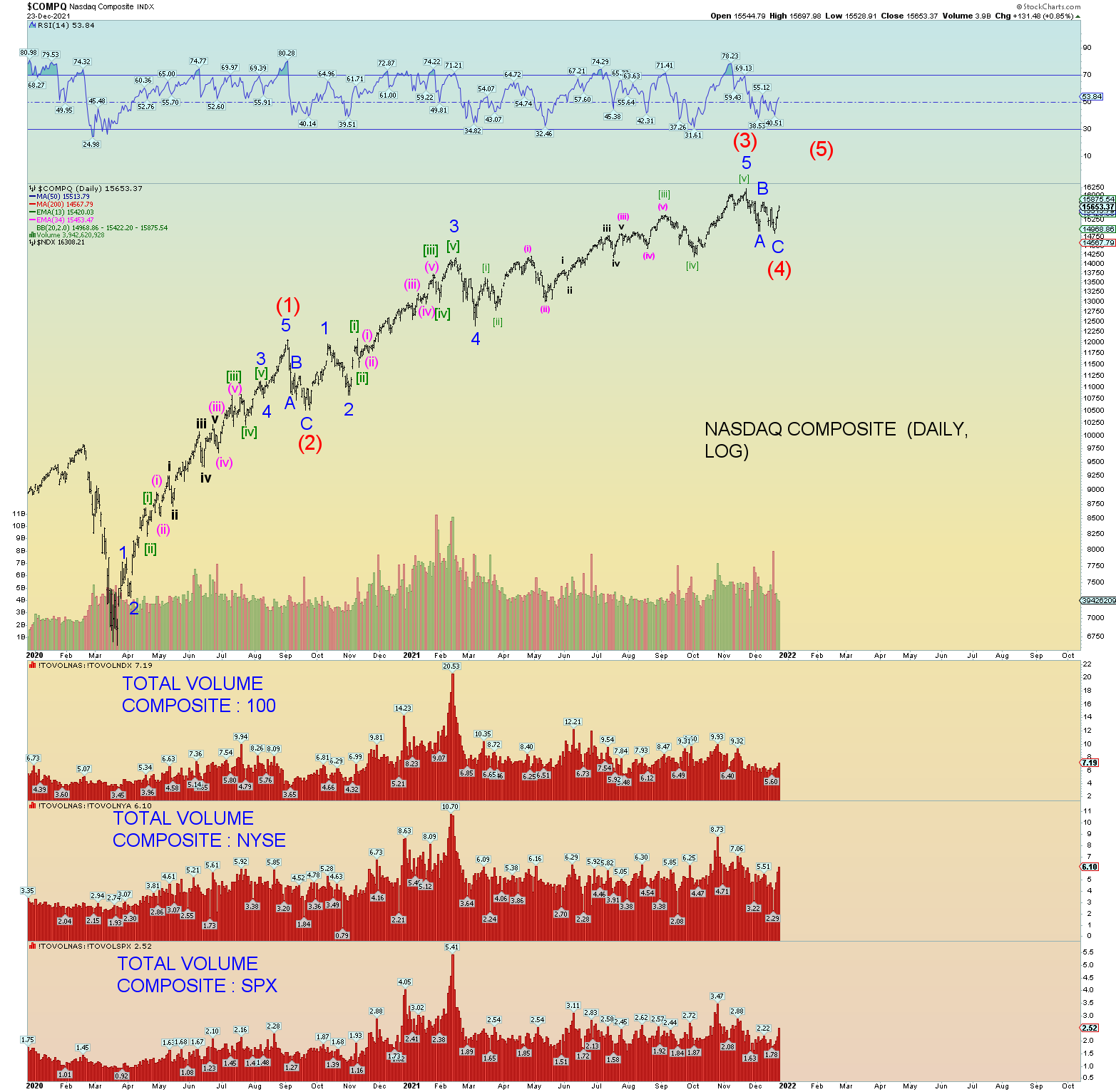

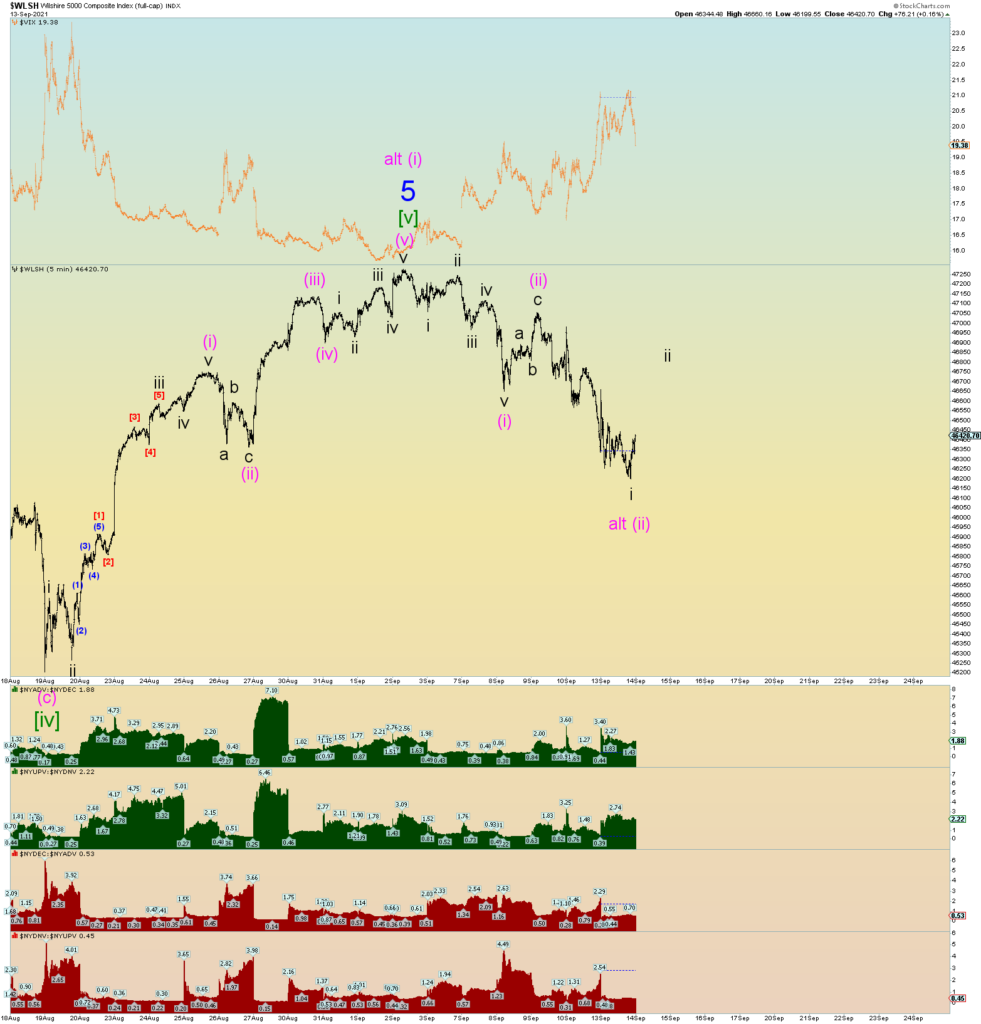

The core concept revolves around the idea that market prices don't move randomly. Instead, they oscillate between impulsive, or motive phases, and corrective phases across all time scales. This alternating pattern, where trends push prices in a specific direction, followed by corrections, forms the very essence of the Elliott Wave theory. It suggests that the market itself inherently follows a rhythmic pattern, almost like a natural law.

Beyond the technical intricacies, it's worth noting the existence of resources catering to those seeking to understand and apply Elliott Wave Theory. Courses designed to elucidate the method's advantages and weaknesses provide a more nuanced appreciation. Such a course acknowledges the complexities of the theory while offering a balanced view, thereby equipping the user with a practical understanding of its application.

It's essential to acknowledge the different approaches to market analysis that are available. For instance, an entry-level trend plan might offer daily trend analysis, but not necessarily incorporating Elliott Wave or Hurst cycles. However, even these plans may include Elliott Wave counts on instruments such as Bitcoin. The diversity of approaches highlights the dynamic nature of financial analysis, where different methodologies are used based on the analyst's expertise and market conditions.

The use of Elliott Wave in real-world trading requires a constant assessment of its application within the actual movements of the market. Consider the situation where the market surpasses the high of the previous day. The analyst may maintain a primary count. This is a way of explaining that the current high represents the 4th wave of a C wave as the analysis continues to unfold.

The evolution of financial analysis involves not only the development of new methods but also the formal protection of intellectual property. Elliott Wave Street is a registered trademark of World Markets Academy LLC, with the protection afforded by both the United States Patent and Trademark Office (Serial Number 88024216 and Registration Number 5743738). This safeguards the name and branding. Unauthorized use of the name Elliott Wave Street without permission is strictly prohibited. This emphasizes the legal aspects of using and distributing financial information, which ensures proper conduct and compliance.

The analyst is often armed with tools like Elliott Wave theory, technical analysis, and social mood commentary. It is a framework that supports the interpretation of market dynamics. The same principle can be applied to social sentiment to analyze broader market behavior.

It is important to remember that understanding the financial markets relies on being well informed, and in a rapidly changing world. Financial analysts consistently try to provide their readers with access to all available information, and the interpretation of that information is crucial for those engaged in financial markets.

The repeated mention of "5 waves down from 1.0529" in the provided context is a specific reference point within a particular Elliott Wave analysis. It's a technical signal. It implies that a sequence of five downward waves has been identified, and the price movement is expected to decline from a specific level (1.0529). This sort of detail is very important to the application of Elliott Wave theory.

The use of technical analysis, combined with social mood commentary and Elliott Wave theory, demonstrates the multi-faceted approach often used by financial professionals. This includes identifying opportunities and assessing risk. The ability to apply various analytical methodologies makes an analyst better positioned to interpret the market data.

The analyst will try to explain Elliott Wave theory to their subscribers in a way that is easy to understand. It's a testament to their dedication to providing useful and understandable information.

The reference to "2520 (again) proof it links to ezekial 45:12" requires some decoding. This suggests a connection between Elliott Wave analysis and biblical numerology. This is a reference to the potential intersection of different systems, which can provide further insight into the behavior of the markets. It is a complex element in the overall study of financial markets.

The ongoing discussions, the "friendly, knowledgeable, and collegial forum community," that's available, creates a dynamic platform for exchanging information, testing ideas, and learning from others. It underlines the collaborative nature of analysis in the financial world.

The observations made on February 28th regarding the potential completion of a pattern involving "5 waves down from 1.0529" is a reflection of the dynamic and predictive nature of Elliott Wave analysis. This is the heart of market forecasting based on price charts, a key component to understanding the dynamics that shape markets.