Are you a tax professional seeking to optimize your practice and navigate the complexities of tax season with confidence? Drake Software stands as a robust solution, offering comprehensive tools and support to streamline your tax preparation workflow and empower your business for sustained success.

In the dynamic landscape of tax preparation, staying ahead requires embracing innovative solutions that enhance efficiency and ensure compliance. Drake Software emerges as a comprehensive suite of tools designed to meet the diverse needs of tax professionals. Whether you're a seasoned accountant or a burgeoning tax preparer, understanding the capabilities of Drake Software is crucial for thriving in this demanding industry.

Drake software is a product of Drake Enterprises, a company dedicated to providing software solutions for tax professionals. Drake Tax is the flagship product that supports a variety of tax preparation needs.

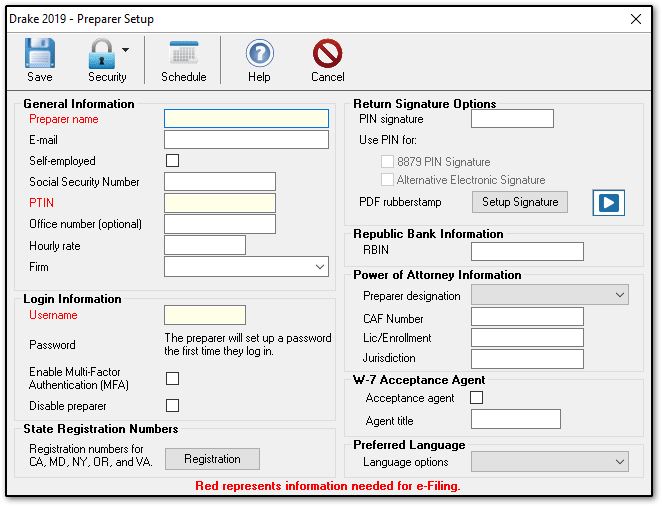

For businesses with a single tax return preparer (PTIN holder), the single-user versions of Drake Tax Pro and Drake Tax 1040 offer a tailored solution. Remember, anyone with a PTIN who prepares or significantly aids in preparing tax returns is considered a tax preparer and is counted as a user. The single-user version is designed to accommodate a single user, providing a focused and streamlined experience. As a professional user of Drake Tax, you can prepare tax returns for an individual, business, federal, or state entities.

Drake Software extends beyond desktop applications, encompassing cloud and online solutions. This flexibility ensures that you can access your tax preparation tools from virtually anywhere, enhancing your ability to serve clients and manage your practice with greater efficiency. Drake Tax online provides full tax compliance.

Here is a summary table with key details of Drake Tax software:

| Feature | Description |

|---|---|

| Core Functionality | Comprehensive tax preparation software for individuals, businesses, federal, and state returns. |

| Deployment Options | Desktop, cloud, and online solutions. |

| User Types | Designed for single-user and multi-user environments. |

| Key Features | Workflow options, client data import, online help, and knowledge base integration. |

| Supported Tax Types | All federal tax packages and state returns. |

| Additional Features | Trial software availability, file conversion from other programs, instructional videos, and classroom training. |

Reference website: drakesoftware.com

Navigating the software landscape requires understanding how to get started. You can download and install Drake Tax (federal and state programs) from the Drake Download Center. During the setup process, you'll need to enter your account and serial number, choose the tax year and states you'll be working with, and review the system requirements and any new features.

A key feature of Drake Software is its commitment to ease of use. You can learn how to use Drake Tax through a variety of resources, including short instructional videos, classroom training, and live webcasts. This ensures that you can quickly familiarize yourself with the software and begin utilizing its full potential. Content with closed captions [CC] is available to enhance accessibility and learning. Resources are available to get the most out of the drake software suite of products.

Drake Tax offers several features to help tax pros navigate the filing process. The platform integrates with drake portals to import client data into drake tax, reducing or eliminating the need for data entry. Additionally, integrated new online help features inside drake tax will take users directly to program help information online and knowledge base articles.

Drake Software's trial offering provides an opportunity to test the ease and functionality of the program on your own computer. You can utilize the trial software to evaluate features and even convert files from your previous software provider (where supported). This allows you to assess the software's capabilities and make an informed decision about its suitability for your practice.

Drake Tax offers a unique approach to product access and file management. Consider an example: If you purchased Drake Tax 2024, you can install Drake Tax 2023 in trial mode and convert files from your prior software provider. This allows you to review the converted data. When Drake Tax 2024 is released, you can easily update your converted files from Drake Tax 2023 to Drake Tax 2024.

For customers seeking comprehensive support, Drake provides the tools and resources tax professionals need to build their businesses and attract new clients. Drake Software customers can download and install available versions of Drake Tax (federal and state programs) through the Drake Download Center. These resources, including FAQs and user manuals, are designed to empower tax professionals with the knowledge and assistance needed to succeed.

The discontinuation of the CD service, beginning with Drake Tax 2024, signals a shift toward digital distribution and online support, ensuring a more streamlined and readily accessible user experience. Tax year 2019 III drake tax users manual and tax year 2019 support are available to enhance your software use experience.

Drake Tax will be available for purchase on April 17th!

Drake Tax offers several versions to cater to different practice sizes and needs. The 2024 Drake Tax Pro Unlimited package, for instance, is a comprehensive solution offering workflow options.

Drake pay is also available, with free registration.

More than 70,000 tax professionals nationwide rely on Drake. This widespread adoption speaks to the software's reliability, effectiveness, and value. Our customers know they can rely on Drake for comprehensive product excellence and value.

Drake Tax\u00ae serves as the hub of your practice, streamlining tax return preparation and enabling you to delight your customers. Drake Tax is complete, professional, and comprehensive tax software, allowing you to prepare any tax return, personal or business, federal or state.

For current Drake customers, logging into your account to renew your software ensures continued access to the latest features, updates, and support. Drake includes all federal tax packages.

Special tax treatment for smllc is another feature which can be explored.